The other day a friend of mine asked me on how he can receive payments online for a small website he is getting developed for an Eye-care NGO in India. Doing some research online and speaking to my dev team I gathered information on the subject, which I am sharing here.

To receive money online, you need to integrate with a Payment gateway, most of the gateways accept Net Banking, Credit Card, Debit Cards and nowadays Digital Wallets.

India

For receiving money in Rupee (INR) or to an Indian Entity, Indian Payment Gateways are the best due to their compliance with local rules of Government of India & Reserve Bank of India (RBI).

- EBS: Starts with annual fees of Rs.4799, 1.5% fees for Credit Card/NetBanking

- CCAvenue: Starts with annual fees of Rs.1200, 1.99% (+ Rs.3) for Domestic Credit Cards/Netbanking and 2.99% (+ Rs.3) for international cards

- PayU: You can accept in 13 currencies including INR, USD, GBP, EUR and more. Cards, Netbanking, wallets and even IVR. One time fee of Rs.4900, 0.75% for Domestic Debit Cards, 2.95% for Credit Cards/Netbanking and 2.99% + 0.75% for international cards. They provide Mobile SDK for Android, iOS & other platforms.

- PayTM: Mobile SDK for Android, iOS, SDK for PHP, C#, Rails, JSP and more, Plugins for popular e-commerce software platforms including Magento, VirtueMart, OpenCart, WordPress and more. Zero setup fee, no Annual maintenance charges, 2.5% of every successful transaction.

- InstaMogo: Charges 2% + Rs.3 per successful transaction. No need to learn to code, works with or without a website. They provide a free online store as well.

- DirecPay: Allows you to get payments through Credit Card, Debit Card, Internet Banking and Mobile

- HDFC Merchant Services: Banks like HDFC and ICICI offer payment gateways for accepting credit cards, but engaging with them the volume requirement will be high. Not recommended for small vendors, for whom it’s better to work with aggregator like the others listed above

- CitrusPay: Charges 1.99% + Rs.3 per transaction with an annual maintenance cost of Rs.1200.

Update 1/Sep/2017: I got a suggestion from a friend to add Razor Pay: Collect payments online through credit card, debit card, net-banking and popular wallets including JioMoney, Mobikwik, PayUmoney, Airtel Money, FreeCharge, Ola Money and PayZapp. One-Time Setup & Annual Maintenance Fee: Rs.Zero; Net Banking, UPI, Wallets: 2% Flat; International, Amex: 3% Flat.

International

If you want to receive funds in US Dollars you can consider the following US based payment gateway/aggregators.

- PayPal: The market leader in the space, they have advanced features like subscriptions, recurring billing and more. For a simple website, PayPal will be the easiest to setup and integrate.

- BrainTree: This is a PayPal company that allows you to receive payments from web& mobile. Simple SDKs for all popular platforms, support Apple Pay, Android Pay, Venmo, PayPal, Bitcom and more. Uber & Airbnb are customers of Braintree. No minimum or monthly fees, 2.9% + $.30 per transaction.

- Authorize.NET: Accept all major credit cards, Apple Pay, Debit Cards. They allow recurring billing. You don’t need to store credit card information but have it securely stored with them. $25 Monthly Gateway and 2.9% + $.30 per transaction.

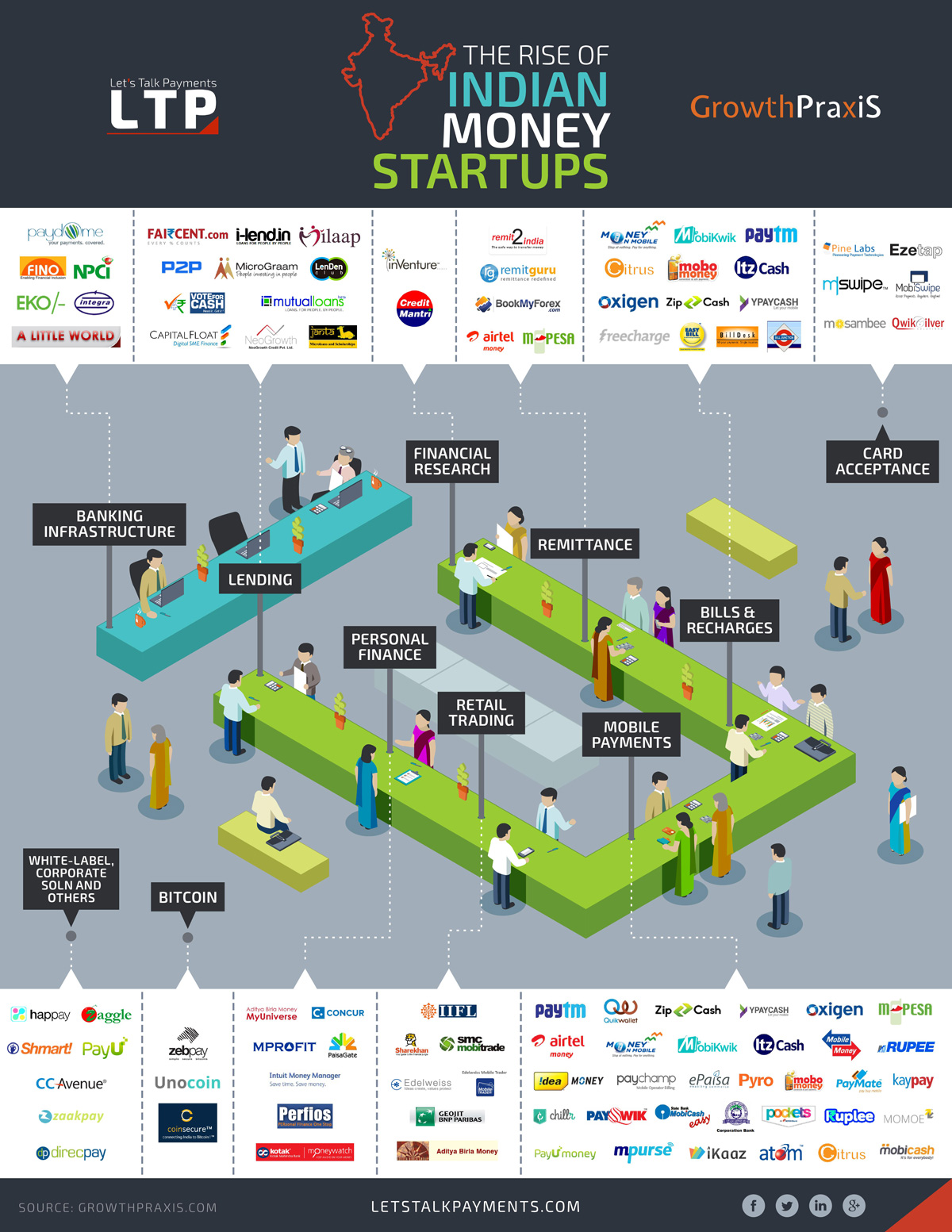

Related to this topic, I found LetsTalkPayments a useful site covering the payment space worldwide. Read their recently published article on hottest FinTech startups in India and below an infographic on India Payments startup space.

Disclaimer: I am not an authority on this subject or affiliated with the brands written above. The links are meant to give you an overview only. Prices and features are what I found as on date of posting.

Thank you so much for sharing this information. I have been using EBS payment gateway since last 6 months and very much happy. The technical team is also helpful and always available to resolve any issue. You can go live with EBS with minimum manual intervention, we can accept payments with major payment option on day 1 of online activation.

Nice post Venkatarangan, comprehensively covered! You seemed to have missed CitrusPay in the list of Indian Payment Solutions provider. CitrusPay power payments for 10,000+ merchants in India and a user base of 21milliion+

Few of the credible merchants associated with Citrus are Pune Municipal Corporation, Delhi Metro, Delhi Jal Board, PVR, INOX, BookMyShow, ShopClues, Jet Airways, Indigo, GoAir, Runnr, Faasos, Grofers, ZoomCar, Airtel, etc.

I have included CitrusPay, Thanks for pointing it out.